tax credit survey mean

It is not done on all sales as the lots are generally plotted already and there is no need for it most of the time. Chief Executive of charity Turn2us commented Todays vote in the House of Commons will mean one thing for many of the poorest working.

Pre-Hire During the Application Process If you apply to a company who utilizes the WOTC before hire you will be asked to complete the questionnaire as part of the application process.

. Hello WOTC is a tax credit that is available to employersYou might have seen the WOTC forms as part of an employment application or more likely part of the new hire paperwork if you were hired. After submitting your application you will be asked to complete the WOTC. Tax credit questions become part of the application and applicants view the extra 30 seconds to two minutes that are required to complete the hiring incentive questions as just another step in.

Thats what tax pros mean when they say tax credits are a dollar-for-dollar reduction in. Answer the questions and provide your e-signature. Completing a Tax Credit Survey Work Opportunity Tax Credit WOTC is a federal tax credit provided to employers for promoting the hiring of individuals from certain groups who might face barriers to fair employment.

The amount of the credit is 100 of the first 2000 of qualified education expenses you paid for each eligible student and 25 of the next 2000 of qualified education expenses you paid for that student. A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit. We request that you complete the following survey to determine if our company may be eligible for tax credits based on our hiring practices.

Also referred to as the AOTC the American Opportunity Tax Credit is for qualified education expenses you pay for yourself your spouse or your dependents. Let me ask you I promise not to do anything bad with your SS want to post it on CD we know the answer already. A tax credit is a tax incentive which allows certain taxpayers to.

A tax credit survey checks to see if the quality assurance service technical equipment including software systems databases and analytics works properly. A survey by End Child Poverty estimated that roughly 15 million parents have reduced. Big companies want the tax credit and it might be a determining factor in selecting one applicant over another.

I earned about 800 this year doing online surveys and in-home testing for market research and was wondering if these count toward the Earned Income Tax Credit. Knowledgeable enough or properly equipped to file for credits or to file for them effectively enough to maximize whats available to them. EMPLOYER WILL NOT SEE YOUR RESPONSES.

A tax credit survey checks to see if the quality assurance service technical equipment including software systems databases and analytics works properly. A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have. Our company participates in a federal employment initiative called the Work Opportunity Tax Credit WOTC.

You can possibly claim a credit equally to 26 percent of an employee. For example if youre the 22 tax bracket and you have a 100 deduction that deduction will save you 22 in taxes 22 of 100. So basically what I am saying is that it sounds like these companies are only fishing for candidates under 40 and that will give them a tax credit.

Parcels outside of town it is more common. Opportunity Tax Credit WOTC the flagship federal program jointly managed by the IRS and Department of Labor. Becaue the questions asked on that survey are very private and frankly offensive.

Land survey if they do one would be listed in the closing document as an expense. Payroll records must also be verified. Work Opportunity Tax Credit.

I dont just give anyone my SSN unless I am hired for a job or for credit. A tax credit is an amount of money given to a taxpayer by the IRS that reduces their tax bill on a dollar-for-dollar basis. The work opportunity tax credit is designed to encourage employers to hire workers from.

Deductions reduce your taxable income while credits lower your tax liability. I also thought that asking for a persons age was discriminatory. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website.

A separate nonrefundable credit that is part of the general business credit. Internal data must be verified in order to ensure accurate data when filling out tax credit surveys. It is one of the last steps in.

Of the government-funded hiring incentives the one with the highest visibility is Work. It asks for your SSN and if you are under 40. However if you have a 100 tax credit it will save you 100 in taxes.

Get Ahead Of The Tax Filing Game In 2022 Filing Taxes Credit Consolidation Online Taxes

Work Opportunity Tax Credit What Is Wotc Adp

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Buying First Home Home Mortgage First Home Buyer

Donation Form Template Free Best Of Free 10 Sample Donation Sheets In Google Docs Donation Request Form Donation Form Donation Request

Work Opportunity Tax Credit What Is Wotc Adp

Cost Of Adoption Survey By Adoptive Families Magazine 2012 2013 Adoption Information Adoption Costs Foster Care Adoption

How Car Brands Compare For Reliability Reliable Cars Car Brands British Car Brands

5 Ways That Freelancers Are Transforming The Economy Infographic Economy Infographic Management Infographic Economy

How Do You Know When To Request A Credit Line Increase Infographic Discover Card Credit Card Statement Balance Transfer Credit Cards

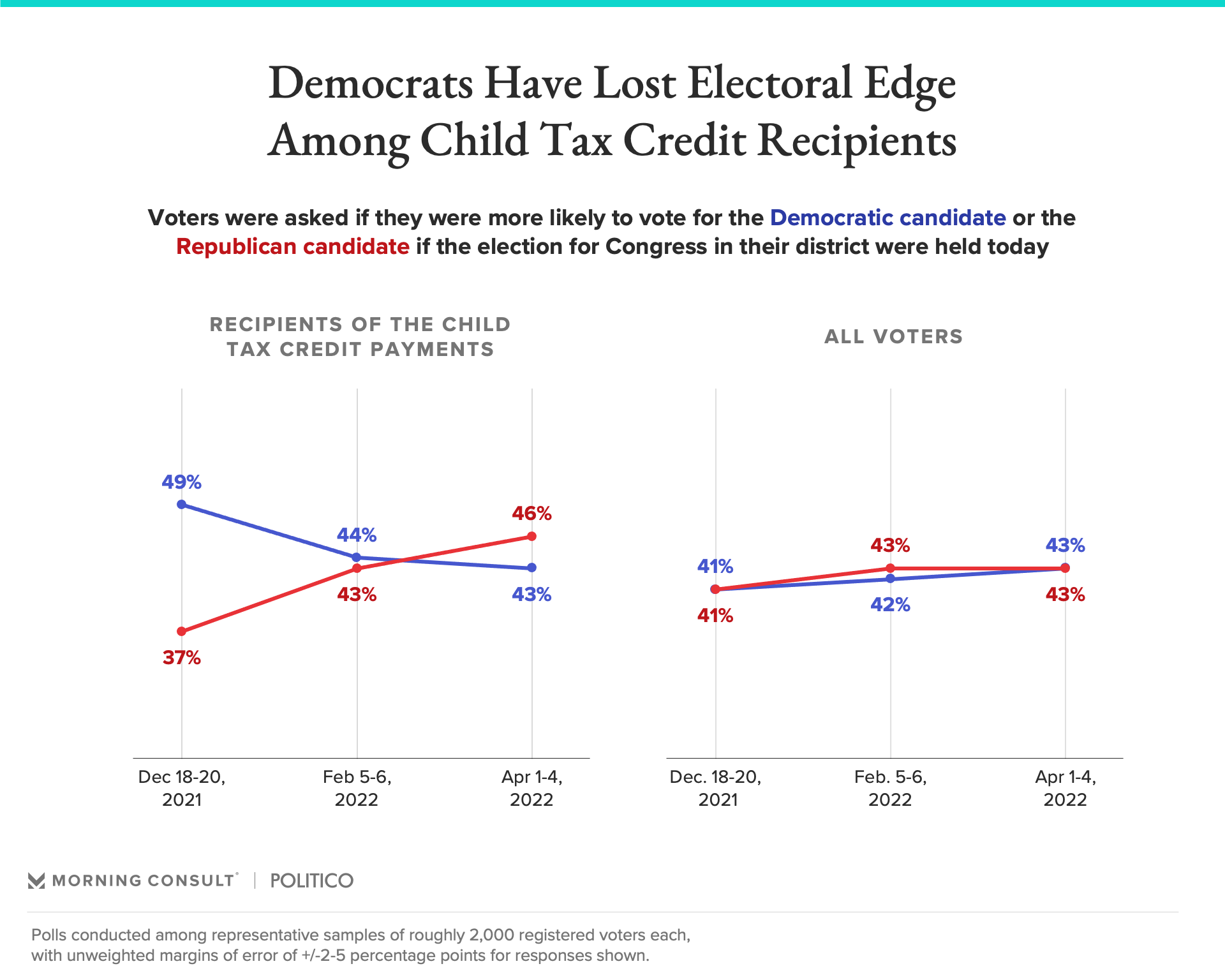

Republicans Favored To Win Senate Among Child Tax Credit Recipients

In A Recent Survey 40 Of Investors Between Ages 18 And 30 Agreed With The Statement I Will Never Feel Comfort Investing Investment Advisor Financial Advice

College Students In The News Education Daily Journal Online Financial Advice Personal Finance Finance

Online Donate Car For Tax Credit Donate Car To Charity California Donate Car Credit Repair Credit Repair Companies

Consolidate Medical Debt With A Medical Loan Medical Loans Medical Debt Medical

Tax Guide For Canadians Buying Us Real Estate Infographic Tax Guide Real Estate Infographic Us Real Estate

Does Buying A House Help With Taxes Real Estate Info Guide Line Of Credit Home Equity Buying First Home